Overview

We have come a long way from the days of caveat emptor. The rise of conscious consumers has lead to a flurry of greenwashing claims sometimes ridiculously blatant, but today’s consumers not only drop more money on products with an ethical edge, they are also leading legal challenges to greenwashing claims. In the case of Australia, while there are no specific anti greenwashing laws, there is existing legal structure which we are seeing that the very active regulators are now leveraging.

For example, the Australian Competition and Consumer Commission (ACCC), in October/November 2022, suo motu conducted an internet sweep to identify misleading environmental and sustainability marketing claims. It included a review of 247 company websites across a range of products including energy, vehicles, household products and appliances, clothing, footwear, and identified 57% of the businesses to have made concerning claims. ACCC has also made misleading environmental claims as one of its enforcement priorities in 2022/23.

In Australia, greenwashing is managed in a multi-pronged manner using provisions in the Australian Corporations Act, Australian Consumer Law, Australian Securities and Investment Commission (ASIC) Act, ASIC’s Info Sheet 271 applicable for public companies, managed funds, and superannuation funds (offering financial products), ISSB framework for sustainability and climate related disclosure, Australian Competition and Consumer Commission Guidelines, and Australian Association of National Advertisers (AANA) Environmental Claims Code.

The litigation/complaints space is also very active with some major judgments in the recent years, and a whole list of interesting litigations that are in process. The litigations/complaints are not just limited to advertisements but can also include materials like the contents of the Annual Statements of the companies which conflict with their marketing claims.

Legal Framework

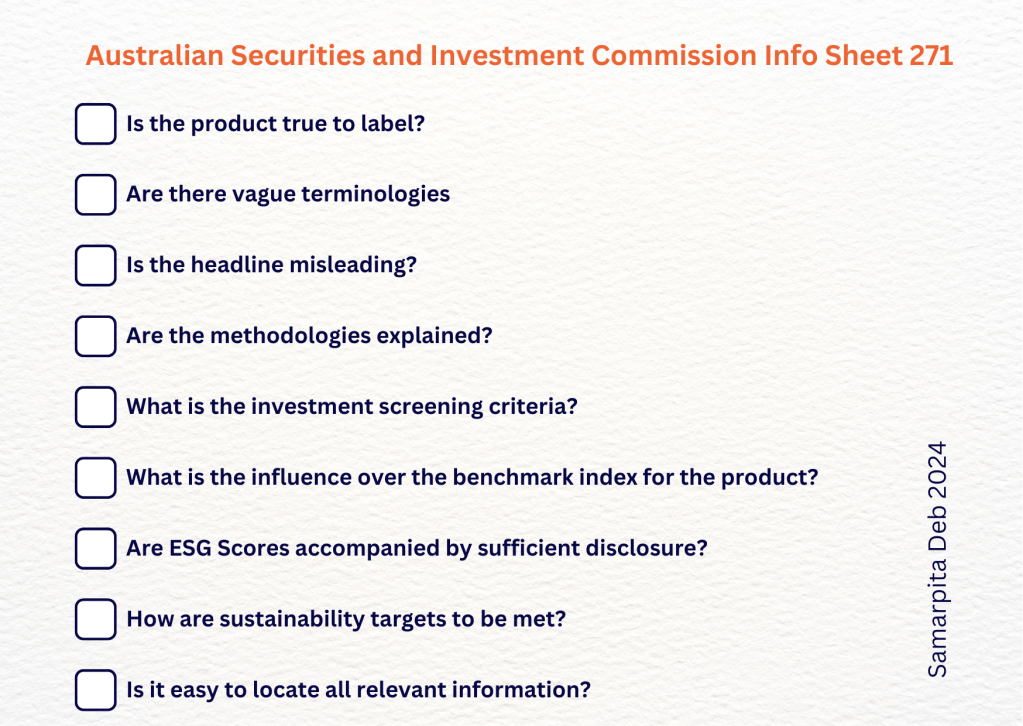

Australian Securities and Investment Commission has released Info Sheet 271 in June 2022 which lays down several guidance principles in connection with offering or promoting sustainability linked financial products by funds. ASIC mentions that the principles will apply to non-fund entities that offer sustainability related products like green bonds by listed entities.

The key greenwashing claims Info Sheet 271 covers are claims relating to: (a) environmental friendliness, (b) sustainability, and (c) ethical aspects.

Info Sheet 271 encourages voluntary disclosure in line with TCFD recommendations. However, from June 2022 there has been a lot of movement in this space with the release of ISSB reporting standards, IFRS S1 and IFRS S2 and subsequently many companies are now aligning with IFRS which is likely going to become the global choice for climate reporting.

ASIC refers to the following existing legal framework that remain applicable for sustainability linked products:

- prohibitions against misleading and deceptive statements under the Corporations Act 2001 and the Australian Securities and Investments Commission Act 2001 both of which contain several general prohibitions against making false/misleading statements or engaging in similar behavior; and

- disclosure obligations under the Corporations Act 2001 and guidelines in Regulatory Guide 65 (RG 65).

Through IS 271, the focus seems to be on two key pillars: (a) truth and (b) clear communication. ASIC has a list of nine questions to be asked along with clear examples which provide good guidance.

- Is the product true to label. As we have seen, financial products have been mischaracterized. Recent litigations are a proof that ASIC intends to follow through when claims are outright misleading.

- Vague Terminology. Avoiding broad, unsubstantiated sustainability related statements or jargons. If terminology, which do not have an universal common understanding, is used, then the contextual meaning needs to be clarified.

- Misleading headline. While it is not possible for headlines to be detailed, balanced headlines are expected.

- Explanation of methodology or policy for integrating sustainability related considerations in to investment decisions. The focus is on clear and adequate explanation.

- Investment screening criteria. The disclosures should enable investors to fully understand the product’s screening criteria that pertains to the sustainability claims. Exceptions and qualifications need to be prominently disclosed which goes towards the focus on clear communication.

- Influence over the benchmark index for issuer’s product must be disclosed.

- Use of metrics like ESG Scores need to be accompanied by disclosure regarding the extent to which the metrics are used for evaluation, the source of the metrics, description of underlying data and methodology.

- Stated sustainability targets need to be accompanied by clearly stating the target, how it is expected to be met, how is it measured, any assumptions what were relied on to set the target.

- Make it easy for investors to locate and access relevant information in a consistent manner across all mediums.

Follow-up Actions from ASIC

Following the release of IS 271, ASIC made 35 interventions where it has secured 23 corrective disclosure outcomes and issued 11 infringement notices, and 1 civil penalty between July 2022 and March 2023 as part of its investigation in to public companies, managed funds, and superannuation funds about their ESG credentials. The detailed report can be found on ASIC’s website published in May 2023 Report REP 763 ASIC’s recent greenwashing interventions.

All opinions are personal.

Stay in the know,

Samarpita

Leave a comment